Source: Fiserv

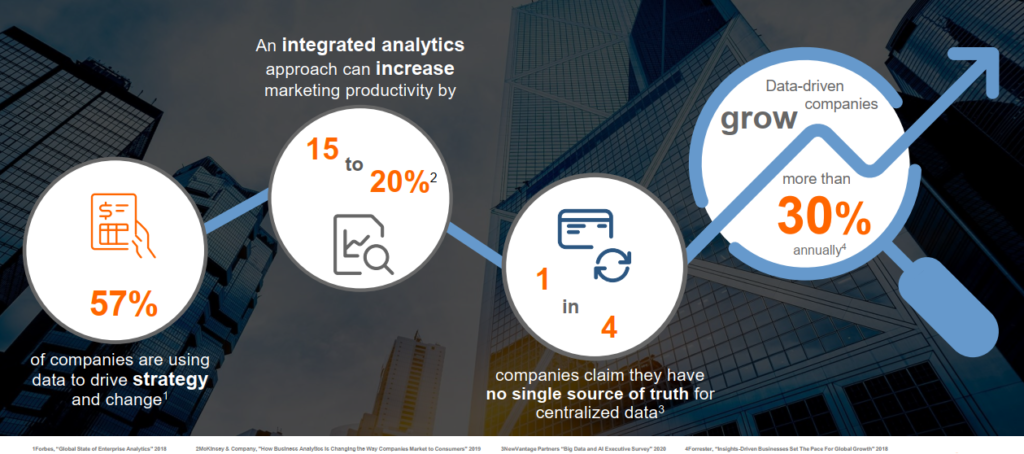

Do you have a cards program? More than likely, your answer is, “yes, of course.” But what are you doing with the data your members are generating with every tap or swipe of their cards? Sometimes, it can feel daunting to know exactly how to dig into vast volumes of data.

The value of data is clear, but it can be hard to gather actionable data in a simple, one-stop location. You want to be able to quickly and easily see the full picture when it comes to your card portfolio.

Card Expert Data Analytics is an on-demand platform that delivers performance insights compiled from your credit and debit card portfolio activity. It allows your team to:

- Analyze, visualize, and share actionable data

- Execute more informed, data-driven business decisions

- Access powerful, easy-to-read reporting

- Aggregate data balanced against other industry metrics, including Visa and Mastercard

“Credit unions need to have a way to readily and quickly view their overall card program performance,” shared Karen Martin, Product Owner – Payments for Synergent. “With Card Expert, they achieve this while leveraging their own payment data, aggregated and presented based on industry metrics. By having full insight into their cardholder spending patterns, they can identify opportunities to tailor their portfolio growth strategies.”

How It Works

Whether your Product Manager, Marketing Director, CFO, or CEO is accessing the dashboard, this is a tool that truly has something for everyone. All member cardholder data and programs are consolidated into a suite of dashboards:

- Executive Dashboard: Assess the financial health of a card portfolio overall or filtered by card type.

- View key performance indicators and profitability analytics

- Evaluate critical growth metrics using all portfolio data points

- Summary Dashboard: Aggregate key portfolio metrics to evaluate performance.

- Interpret year-to-date credit line use and revenue projections

- Use data to make decisions based on quick account balance and growth projection

analysis

- Revenue Dashboard: Evaluate monthly income streams to monitor the overall health of your card portfolio.

- Consider detailed fee, interchange, and finance charge income

- Access a portfolio revenue summary to analyze performance

- Purchases Dashboard: Analyze consumer spending trends to see the impact that spending habits have on your revenue.

- View usage summary statistics by month, product, and merchant type

- Understand purchase entry modes and preferred spending categories

- Accounts Dashboard: Forecast new account growth by reviewing cardholder account details to mitigate risk.

- View quantitative segmentation information for active accounts

- Evaluate revolving and transacting member trends

- Specialized Dashboards: Delinquency and Loss, Purchase by Location, and Digital Wallet dashboards can provide additional insights driven by analytics.

Easy-to-use reporting extends beyond the dashboards. The Balances Report pulls information from the dashboard reporting and empowers credit unions to use key metrics and graphs for credit limit use. They can analyze month-over-month spending, manage credit line risk, and make data-driven decisions to promote card use by targeting underutilized credit lines!

Key Benefits

Card Expert provides many benefits, including the ability to:

- Consolidate member cardholder data

- Track key areas of card portfolio

- Identify consumer behavior and key trends:

- Top Merchants

- Point-of-Sale Summary

- Cardholder Activation, Penetration, and Usage

- Approval and Decline Rates

- Network Spending Trends

- Digital Wallet Activity

- Quickly grant access to existing token users

Basic Toolkit vs. Expert Toolkit

Card Expert is offered in two packages to best meet credit union needs. The Basic Toolkit will provide easy to understand key metrics in a professional dashboard view. The Expert level will allow you to export your metrics and perform data drilldowns.

Free Trial

All Synergent Fiserv EFT credit unions are invited to try Card Expert free through June 30! We encourage you to sign up now to have as much time as possible to try out Card Expert or Card Expert Toolkit.

Complete the form today to begin your free trial!

Sign Up for the April 22 Card Expert Webinar

If you haven’t already signed up, please be sure to join us for our ongoing Synergent & Fiserv webinar series. On the last Thursday of each month at 1:00 pm ET, we provide webinars designed to enhance, grow, and protect your Payments programs.

The April webinar is dedicated to Card Expert. Register today for this series and join us on April 22!

Learn More

Card Expert is available to all Synergent Fiserv EFT credit unions as an add-on feature. For additional information on implementing Card Expert at your credit union, please contact your Account Relationship Manager, or email ARM@synergentcorp.com.