Staying ahead of the curve with fraud security options for your members is essential in today’s dramatically changing payments landscape. Winslow Community FCU in Maine (Assets: $39M, Members: 4,700) partnered with Synergent Marketing Services to launch a fraud prevention campaign to encourage their members to sign up for text and/or email alerts to protect their debit cards.

Staying ahead of the curve with fraud security options for your members is essential in today’s dramatically changing payments landscape. Winslow Community FCU in Maine (Assets: $39M, Members: 4,700) partnered with Synergent Marketing Services to launch a fraud prevention campaign to encourage their members to sign up for text and/or email alerts to protect their debit cards.

Globally, billions of dollars are lost each year to card fraud. Conversely, cardholders expect their cards to work on demand. 39% of cardholders who had a transaction falsely declined due to fraud concerns by the card issuer abandoned their card entirely — this can translate into significant losses for a credit union.

The Campaign

“We recently implemented Risk Advisor and wanted a way to reach all of our debit card members to offer them text and/or email alerts for debit card fraud prevention,” shared Robyn Loubier, Marketing Specialist at Winslow Community FCU. “With the help of the Synergent Marketing Services team, although it was a bit more than we wanted to spend, we worked together to create a mailer that did just that and also included a prepaid return envelope. We had an overwhelming response rate of 26% and they are still trickling in! It was definitely worth it to be able to provide our debit card members some piece of mind.”

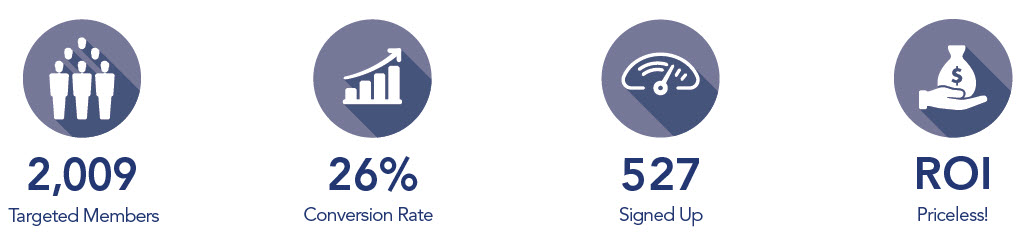

Sending a simple letter with easy-to-reply-to options quickly spread the message to Winslow Community FCU’s 2,009 debit card members. The campaign cost $2,565 — and the return on this investment is immeasurable. With members signing up for the alerts, it is one more tool to warn credit unions of suspicious transactions, preventing loss both for the member and the credit union. Of the 2,009 recipients who were mailed the letter, 527 signed up for fraud alerts during the two month campaign period. That’s a 26% conversion rate, and the sign-ups continue to roll in!

The Product: Risk Advisor

Your credit union may already be using Risk Advisor for fraud detection. The key to the success of this product is making sure members are aware of what it is, how it works, and ensuring phone numbers and emails are collected and added to the system. Risk Advisor includes services such as:

- Transactions routing 100% to real-time

- Automated Risk Exemptions (ARES)

- An assigned risk analyst for consulting and recommendations

- A rule-authoring service

- A premium fraud rule package

- Analysis of tagged fraud transactions

- Customizable cardholder notification actions

- Monthly risk portfolio report

The Offer

- Sign up via an easy-to-complete form to receive alerts via text and/or email when fraud is detected

Target Audience

- 2,009 members with debit cards

Return on Investment

- 527 members signed up for fraud alerts

- 26% conversion rate

- Return on investment: priceless!

Preventing fraud saves credit unions immeasurable amounts, which is a significant value that limits losses and boosts member confidence — a proven way to increase card usage!

Creative Services Included

- Comprehensive Creative Concept and Design

- Recapture Data Mining

- Full-Color Letters

- #10 Custom Envelopes

- #9 Return Envelopes

- Companion Email

- List Preparation and Mailing Services

- Tracking, Monitoring and Reporting

Learn More

Download a PDF of the case study. For more information on how to launch a similar campaign at your credit union, contact your Marketing Service Representative, or email marketingservice@synergentcorp.com.