Credit unions generate a lot of data, which can be used to make calculated, strategic operational decisions. In the coming weeks, Account Relationship Managers will begin sharing the new Credit Union Data Scorecard during their monthly calls with credit unions who access Symitar® Episys® core processing through Synergent.

Credit unions generate a lot of data, which can be used to make calculated, strategic operational decisions. In the coming weeks, Account Relationship Managers will begin sharing the new Credit Union Data Scorecard during their monthly calls with credit unions who access Symitar® Episys® core processing through Synergent.

The Credit Union Data Scorecards are created with three goals in mind:

1. Foster a data-oriented mindset among credit unions.

2. Spark discussions about how we can help credit unions achieve their goals.

3. Assist credit unions in measuring their progress toward goals to help them better serve their communities.

By The Numbers

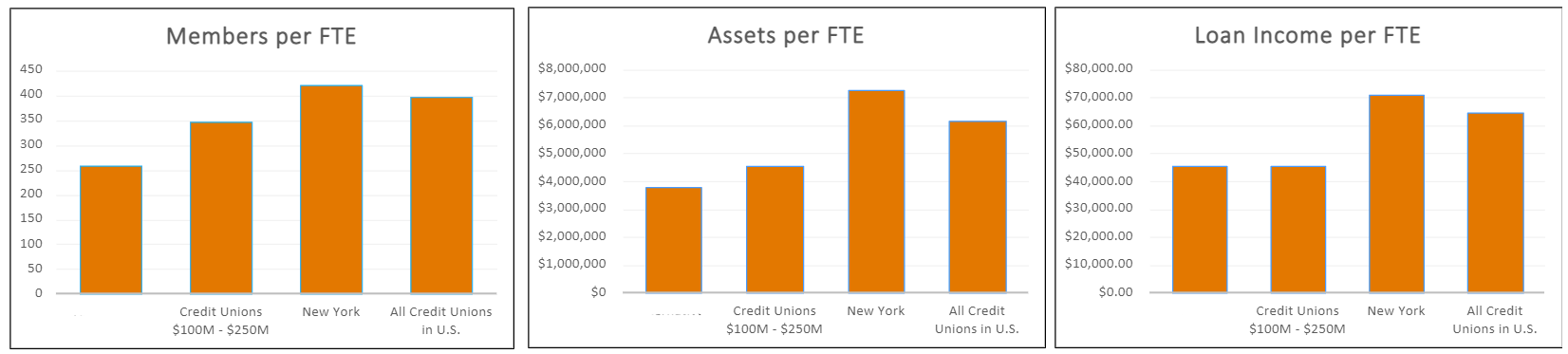

The charts included in the Scorecard focus on three primary metrics that point to how well the credit union is using the resources they currently have:

1. Members per Full-Time Employee (FTE)

2. Assets per FTE

3. Loan Income per FTE

“There is a lot of pressure on credit unions to find and retain talent in the current environment,” explained Jeff Will, Assistant Vice President of Product Development at Synergent. “The more we can help credit unions amplify the staff they already have, the more they are able to focus on their core strength: building relationship with their members. Providing them with data and metrics that demonstrate how well they are making use of their resources drives discussions about the solutions we can provide to help them make even better use of those resources, ultimately benefitting members in the end.”

In analyzing members, assets, and loan income per full-time employee, the metrics are “throughput,” meaning they reflect how efficiently and effectively the credit union is using their resources. The higher the number of members, assets, and loan income per full-time employee, the better.

“In addition to sharing the credit union’s ‘per FTE’ ratios, we also chart a comparison against their peer groups across asset size, region, and the entire country,” explained Will. “As a way to help set appropriate goals, most credit unions find it helpful to see the comparison to their peer groups.”

Next Steps

There’s nothing your credit union needs to do at this time. The Account Relationship Manager assigned to each core credit union will be reaching out with this information in the coming weeks. If you have additional questions, please reach out to them directly, or email ARM@synergentcorp.com.