In the always evolving, fast-moving world of payments, having a partner who can help you stay up-to-date on the latest trends is a competitive advantage. By working with your Synergent Payments and Fraud Consultant, you can maximize payment strategies and be proactive in protecting members from fraud.

In the always evolving, fast-moving world of payments, having a partner who can help you stay up-to-date on the latest trends is a competitive advantage. By working with your Synergent Payments and Fraud Consultant, you can maximize payment strategies and be proactive in protecting members from fraud.

As a Synergent credit union, you have a trusted resource ready to work with you. Rebekah Higgins, Payments and Fraud Consultant, has over 20 years of experience at Synergent alone. As a subject matter expert, she has presented at numerous credit unions and conferences, and regularly appears in the media as a thought leader. Her involvement in several payment advisory committees has helped credit unions be heard at both the local and national levels.

Consultative services offered include:

- A review of the payments landscape at large

- Product portfolio reviews

- Custom ROI documentation for value-added services

- Focus groups to gather credit union feedback

Disruptors and Emerging Trends

Your credit union’s payments offerings are a key differentiator that get members in the door. Competition is everywhere! Members seek fast, modern ways to access their funds and for credit unions, this area can be the largest income generator beyond interest income.

“Digital wallets, real-time payments, peer-to-peer payments—these are all key products and services members demand,” stresses Higgins. “If you don’t have what members want, and you aren’t communicating it effectively, they will go somewhere else to get it. This can seriously impact credit unions’ bottom lines if they are going elsewhere for services.”

Peer-to-peer (P2P) payment providers like Zelle, Fed-Now Instant Payments, and Real-Time Payments (RTP) are all examples of new and emerging disruptors in the payments space. In Q1 of 2021, 392 million payments totaling over $100 billion were sent through Zelle. Fed Now is being developed by the Federal Reserve banks as a safe, efficient service for instant payments through all FIs that will be available 24/7/365 and is expected to launch in 2023. RTP Launched in November 2017 and reaches 56% of all DDAs in the U.S. to address payment scenarios beyond P2P.

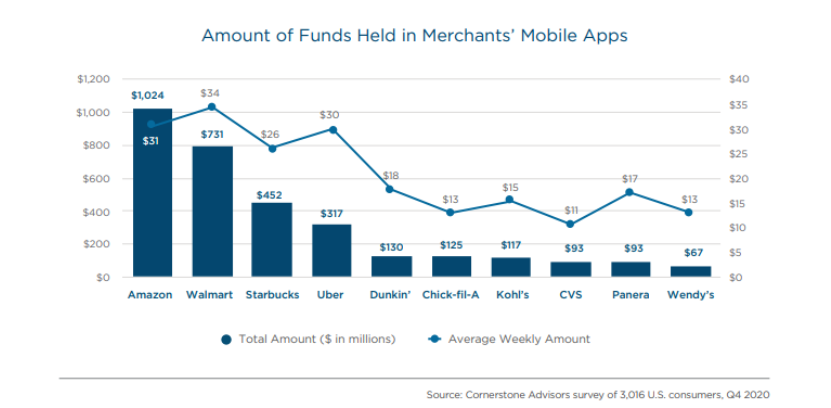

Another disruptor: mobile wallets are catching up to cash. Last year, 10% of spend at POS terminals leveraged a digital or mobile wallet in the U.S. Cash was just ahead at 11.9% and globally, the use of cash as dropped a whopping 42% since 2019! Venmo, Apple Pay, and retailer-held digital wallets are examples of rising fintech that are moving funds without the assistance of a financial institution.

Schedule Your Consultation

Want to gain some more insight into current payment and fraud trends? To schedule a consultation with Rebekah, please contact your Account Relationship Manager, or email ARM@synergentcorp.com.