Members love to be rewarded. Whether you are using your rewards program benefits as an enticing tool to recruit new members or to reward your loyal, long-term members, there are clear advantages for credit unions offering a strong rewards program.

Members love to be rewarded. Whether you are using your rewards program benefits as an enticing tool to recruit new members or to reward your loyal, long-term members, there are clear advantages for credit unions offering a strong rewards program.

What is Synergent Rewards?

Synergent Rewards is a Symitar® Episys® core-based rewards program designed to help credit unions build strong relationships with members by providing incentives to use specific services. Members are rewarded each month for completing day-to-day transactions in increments defined by your credit union as part of the rewards program.

“Synergent Rewards is integrally valuable in acquiring new members, retaining long-time members, and in making the relationship between your credit union and its members even stronger,” shared Doug MacDonald, Vice President of Synergent Marketing Services. “For the credit union, increased product utilization is a significant benefit realized and helps to achieve top-of-wallet and first app status.”

How It Works

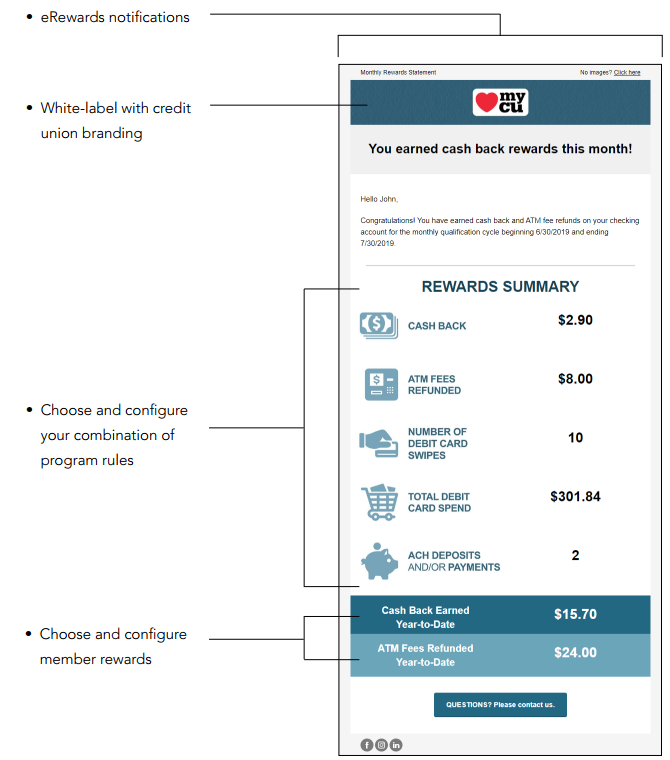

Credit unions set defined criteria for members to qualify for rewards, such as:

- Qualifying card transactions

- Minimum number of ACH or ATM deposits or withdrawals

- Minimum use requirements for digital banking

- eStatement opt-in incentive

- Matching rewards cycle with statement cycle

Rewards earned by members are also defined and highly configurable by your credit union. They may include cash back, ATM fee refunds, or higher yield dividends.

Why Synergent Rewards Is Different

Use Your Own Branding

Your credit union is the star here! Synergent Rewards has the ability to be white-labeled, meaning your brand instantly can be prominently featured. Name it what you want and use your existing branding for a polished, cohesive presentation of your rewards program.

Symitar Episys Core Integration

For credit unions on the Episys core, no additional servers, third-party file transfers, or end-of-month staff time is required. File movement is eliminated, as synced data never leaves the core, flowing only between Episys and Synergent Rewards.

Automated Statement Cycle Processing

Ditch the manual process. Synergent Rewards is housed on Episys and driven by the monthly statement cycle. By working in tandem with your statement cycle, staff can count on rewards aligning with monthly statements and members have more time to accrue points. With automation, there’s never a need for staff to cover manual rewards processing, increasing reliability while saving time and resources.

Security

Rewards programs that are not housed on the core require manual file movements each month. Because Synergent Rewards is part of Episys, there is no data movement, reducing risk and increasing member data security.

Cost

Synergent Rewards is turnkey, Episys-based, and highly cost-effective. In addition to its affordability, credit unions gain increased product usage as members reach for your card or app first to accrue points.

Take A Peek

While the look and feel can and should become your credit union’s own, here is an example of what the Synergent Rewards interface can look like:

Ask the Right Questions

Whether your credit union is looking for a new Rewards provider or is searching for their first Rewards partner, asking the right questions is imperative to your program’s success. When speaking with vendors, we recommend asking the following questions:

- What is included in the Rewards program?

- Who is eligible?

- What kind of Rewards can members earn?

- What are the terms of the contract?

- If I decide to cancel, are there cancellation fees?

- How automated are files and processes?

- When is the rewards cycle and how is it calculated??

- What are the renewal terms?

Case Study: Casco FCU Rewards Checking

Casco FCU, headquartered in Gorham, ME, wanted to offer members an impressive, branded, custom-designed rewards platform. They had previously offered a rewards-based account for many years through a third-party vendor. The program required manual transfers of files, and the credit union struggled with a process that resulted in daily time-consuming tasks, often at inconvenient times. Month-end posting of rewards was an arduous workflow. On top of all that, processing costs and fees were a financial barrier to providing member rewards and benefits.

Casco FCU made the decision to partner with Synergent to develop and implement a new rewards system. The process was seamless from the initial discussion to final product delivery and implementation. Months before “going live” on the new platform, a test was conducted to compare rewards posting with the credit union’s expectations, providing the validation to move forward with greater confidence and for a seamless transition to processing rewards on their core.

The ease of setup, pain-free implementation, and having all rewards post directly from the core to member accounts eliminated the friction and the need to monitor daily transfer files, saving the credit union valuable time and resources.

“Synergent Rewards encourages people to become members, thereby bringing more deposit dollars into the credit union, which we can then loan to our members,” said Marti Allen, VP of Operations at Casco FCU.

Casco FCU saw a 5% increase in Debit/ACH transactions and a monthly average of $5,880 in rewards were paid out to members each month.

For full details, please review the complete case study.

Learn More

Get started by downloading the full product sheet. For information on implementing Synergent Rewards at your credit union, please contact Fred Barber, Account Executive.