Setting the Strategy: Recapturing Your Auto Loan Portfolio

Auto lending is a major component of any credit union’s portfolio. But are you looking to grow originations in a market that wasn’t predicted to be as hot as it is right now? Ensuring that your credit union leverages all tools available – including assessing the current market, using all Episys functionalities available, and maximizing your marketing through the use of data – can help your credit union increase its auto lending portfolio.

CU Auto Loans By-the-Numbers

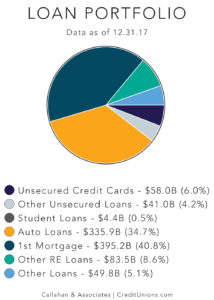

Auto lending is not a small piece of the pie. Focusing on increasing auto lending is a win-win for both members and credit unions. Members are able to receive competitive rates while keeping their loans locally serviced and funded. Credit unions are able to capture both wallet share and market share as their auto loan portfolios grow.

In Q417, across credit unions of all sizes, auto lending comprised 34.7% of all lending, a percentage bested only by first mortgages. This number represents a near 5% increase in auto lending over the past five years. Indirect lending is cited is a primary vehicle for this growth, representing 58.3% of total auto loans at the end of 2017.

Credit unions need to be thoughtful and strategic in their approach to capturing their fair share of auto lending. Building strategy on projections, as well as current market analysis, is essential to lending success. While it would have been sensible to base auto lending efforts on the forecast that 2018 sales were going to fall, the auto market defied projections and is performing far better than expected. Auto sales are not down, and buyers are looking for loans.

“If credit unions’ auto finance originations are in line with projections built on SAAR for 2018, they may be underserving their members,” stated Scott Johnsen, Synergent Senior VP of Operations.

Using the Tools in Your Episys Toolbox

The flexibility of Episys simplifies auto loan scenarios for credit union handling. For example, the Dealer Reserve Accounting add-on module tracks the relationships between auto dealers and others who provide credit unions with indirect loans on the core. Credit unions who use this add-on module are able to automate payments of loan origination funds and reserve amounts to dealers, deduct dealer member fees from reserve amounts, calculate and post a chargeback of reserve amounts, perform amortization, and review loan and reserve balances by dealer to assess the effectiveness and value of their indirect lending plan.

The Participation Loans function of the Member Business Services add-on module enables your credit union to set up and administer the sale of portions of your loan portfolio to other financial institutions and investors. This module provides for the initial identification of one or more loans to be sold, records investor agreements and payments, assesses the service fee for origination and service of the loans, and allows for repayment to participants of loan principal, interest, and late charges.

Magic in the Marketing – Recapture Campaigns

Auto loan campaigns have been standard practice for credit union marketing departments for as long as auto loans have existed. However, not all credit unions focus on the potential business that exists within auto loan recapture campaigns. Leveraging this target audience should not be an afterthought, especially when the process can be implemented in a set-it-and-forget-it manner.

“Data mining guides most of our credit union marketing campaign strategy,” shared Erica Vachon, Senior Marketing Service Representative for Synergent Marketing. “ACH data mining, and transactional data mining in particular, allows us to get surgical in our targeting and messaging. Our ACH loan recapture program has helped many of our credit union partners reach their auto, mortgage, and credit card lending objectives. Add in our expertise in campaign automation – from triggered emails, to mailing letters or postcards on demand – and we’re able to create a lending engine that works behind-the-scenes for our credit unions all year long!”

Merrimack Valley Credit Union, headquartered in Lawrence, MA, targeted four member groups when launching their hybrid recapture campaign:

- Members making auto loan payments to other financial institutions through ACH or Bill Pay

- Members with both a checking account and a personal loan

- Members who paid off their auto loan in the prior 12 months

- Members who were due to pay off their auto loan in the following 6 months

Through customized postcards and emails, members were offered auto loan rates as low as 1.99% and a cash incentive of up to $200. Their seven week campaign period exceeded their expectations, yielding 260 new loans totaling $4,207,573!

“From a marketing perspective, Synergent’s ability to tap into our data and provide business intelligence is very helpful when doing our targeted marketing campaigns,” explained Yean-Ai Long, Vice President of Marketing at Merrimack Valley CU. “We are very pleased with the data analysis they provide in guiding our marketing strategies. It’s important to partner with a company that understands credit union challenges. I feel that Synergent knows us and is an extension of our credit union.”

Learn More

To learn more about tracking trends, Episys loan functionalities, or how to get started on your own recapture campaign, please contact us at rightsolution@synergentcorp.com today!