So much data, so little time. Members are generating data with every swipe of their debit card, every time they use digital banking, and every time they make a payment. Any action taken digitally generates data that can be leveraged to provide members with relevant information and increase ROI. The vast volume of data can be daunting to approach, but it is a very valuable tool that can help leaders make the most informed business decisions.

So much data, so little time. Members are generating data with every swipe of their debit card, every time they use digital banking, and every time they make a payment. Any action taken digitally generates data that can be leveraged to provide members with relevant information and increase ROI. The vast volume of data can be daunting to approach, but it is a very valuable tool that can help leaders make the most informed business decisions.

Synergent BI, the integrated, turnkey business intelligence solution for credit unions that was launched in 2019, continues to evolve based on user feedback. The platform already is known for providing dashboard reporting that collects data from a credit union’s own core, as well as industry sources such as NCUA. The latest feature being added later this month will make Synergent BI even more powerful.

WHAT’S NEW

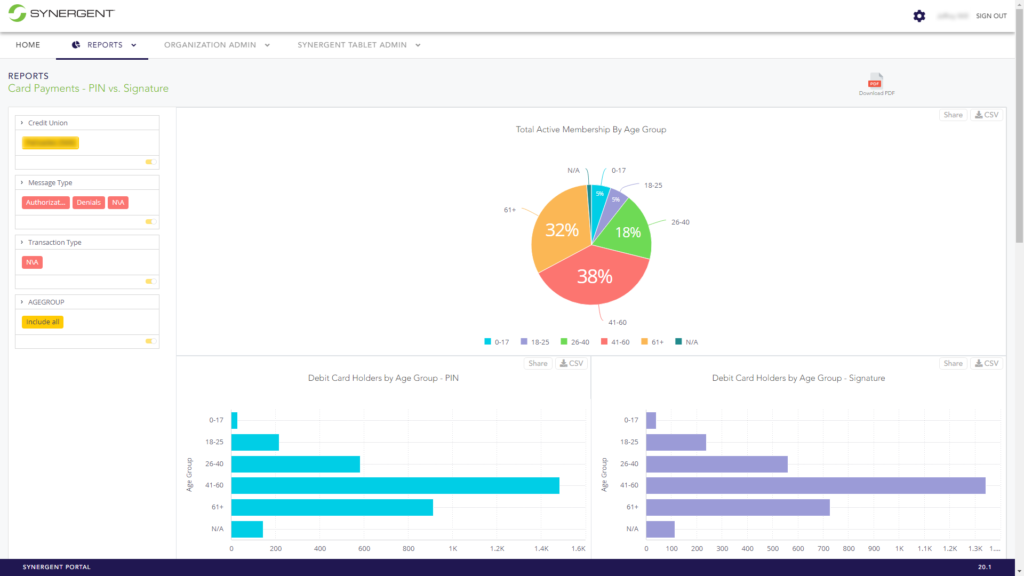

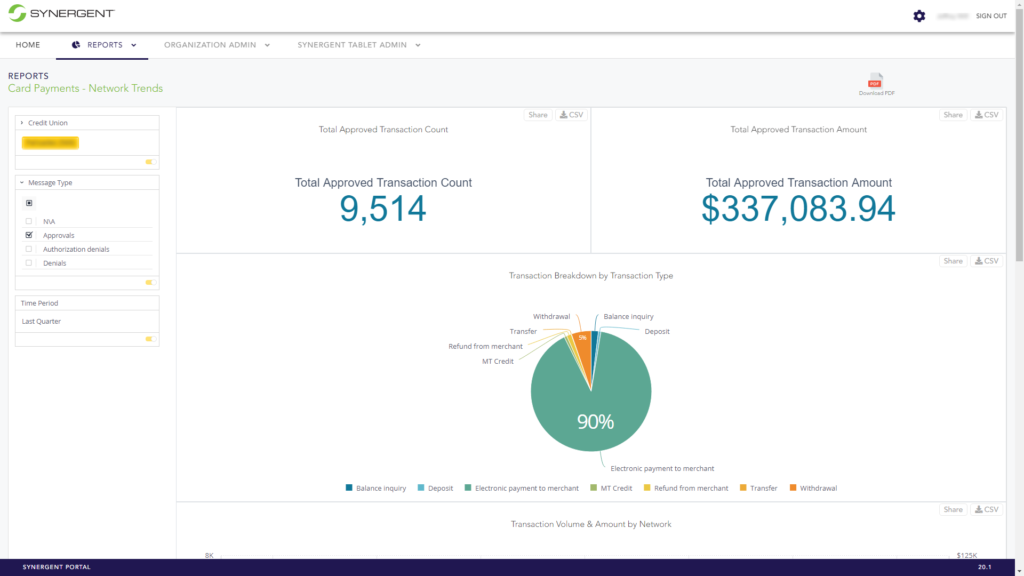

The Payments Dashboards feature within Synergent BI will allow credit unions to gain insight into Fiserv payment data that is not currently available within the core. Through interactive visualizations, users will be able to see a more complete view of their payments data.

The new dashboards provide many insights, including the locations of where members completed transactions, the merchants where payments were made, and which payment networks were used, including which members used them.

“This valuable data helps credit unions identify and incentivize payment-related behavior among their members,” shared Jeff Will, Product Owner – Technology for Synergent.

By using the new payments dashboards, credit union staff will be able to better understand the behavior of cardholders, allowing for visualization of how cards are being used and the ability to anticipate income profitability trends. This forecast can be used to promote beneficial member behavior.

“The Synergent BI Payments Dashboards provide a visual representation of the Fiserv payment data,” elaborated Will. “Several thoughtfully designed widgets help credit unions view the data from different angles based on merchant codes, transaction types, networks, and more. By including denied transactions, credit unions can see more meaningful data from their members’ behavior than is available on the core.”

KEY FEATURES

- Large volumes of Fiserv payments data

- Denied transactions and authorizations

- Merchant code, transaction type, and network data

- Widgets providing multiple views of data

- Easy-to-understand visualizations

- Drill-down capabilities to zero-in on the data sets

IMPLEMENTING PAYMENTS DASHBOARDS

This new feature will be available to Synergent BI Premium+ subscribers in the next few weeks. Please contact Fred Barber, Account Executive, at fbarber@synergentcorp.com with any questions, to learn how to become a new subscriber, or to increase your subscription level to access this functionality.