The start of a new year is a wonderful opportunity to identify and set goals for your credit union. Oxford FCU in Mexico, ME was able to do this by first reflecting upon a campaign that was very successful, then repeating that formula leveraging ACH transactional data over multiple campaigns.

The Reflection

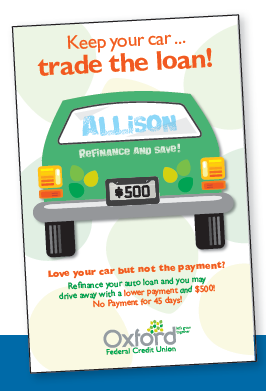

“We used a different approach to reach our members with this campaign. We sent targeted direct mailings to more than 600 members who use ACH transactions to fund auto loan payments at a different financial institution,” said Kim Davis, Marketing Director for Oxford FCU. “Although it was different, the results paid off.”

The Goal

Recapture members making auto loan payments to other financial institutions while increasing Oxford FCU’s auto loan portfolio. Through targeted communications, Oxford FCU offered refinancing with cash back rewards and no payment for 45 days to members identified through ACH analysis and programming.

The Result

After a very successful first run of the campaign, Oxford repeated it. Between the two campaigns,Oxford FCU signed 533 new auto loans totaling over $8 million.

Next Steps

For the full case study and to see samples of other member data-driven campaigns, please contact Synergent’s Direct Marketing Service Representatives at marketingservice@synergentcorp.com.

How did Oxford FCU do it?

Partnering with Synergent Direct Marketing Services, the following elements contributed to their auto loan campaign:

- Campaign strategy and development

- Data review and targeted extract

- ACH analysis and programming

- Creative and content development

- Full color personalized postcards

- List preparation and mailing services

- Unique URL

- Reporting and analysis

- Two-part campaign execution