How well do you understand interchange? Credit unions gain revenue from interchange income, but this a very complex payments function that often is not fully understood.

“Many credit unions are experiencing increased sales volume but are seeing reduced interchange income and don’t understand why,” said Corinne Sherman, Vice President of Payment Sales and Consulting at Synergent. “Understanding the transaction mix—right down to the merchant—matters! For example, some big box retailers negotiate super low interchange rates with various card brands. If a small town is home to a big box store that has negotiated low interchange rates and it is the most accessible store by 25 miles, interchange suffers as a result.”

What Is Interchange?

Let’s start with the basics. Interchange refers to the fees that vendors pay for each credit card or debit card transaction. They usually are calculated as a percentage of the total purchase made and are set by the card networks, such as Visa and Mastercard. These interchange fees are paid to the payment processors and card issuers. They exist to help cover some of the costs incurred with card processing, including chargebacks and risk mitigation.

Beyond the basics is where defining fees can get confusing and is further complicated by frequently changing rates. For example, Visa and Mastercard change their rates twice per year! Other variables include:

- Type of Card: Credit or debit? Gift card? Personal or business? Are rewards tied to the card? All these variables impact interchange fees.

- Type of Business: For example, a supermarket pays more in interchange fees than gas stations. Travel, streaming services, and utilities all incur different interchange fees. The payment rails recognize the different types of businesses because each is assigned a merchant category code (MCC). Interchange rates vary depending on the MCC.

- Merchant Size: The bigger the merchant, often, the lower the interchange rates. This is due to their rate negotiations with Visa and Mastercard that are impacted by the high volume of sales.

- Transaction Type: PIN-based, signature-based, point-of-sale (POS), and card-not-present (CNP) are all transaction types. PIN-based transactions have lower rates due to lower risk, and they are routed through PIN-based networks such as ACCEL and NYCE. Additionally, when the cardholder is physically present at the POS, there is less risk to the credit union than when a card is used for a CNP transaction, such as an online transaction. As a result, the interchange rate on a POS transaction may be less than on a CNP transaction.

So How Does Interchange Work?

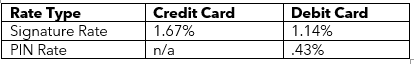

Let’s put the basics and variables into action. Let’s consider online transactions being considered riskier than those completed in-person at a POS. And we know that credit card transactions can incur higher interchange rates than those completed with a debit card. Below is an example of how the rates could differ in a real-life scenario, keeping in mind that the rates change frequently and the information below is being used for illustration purposes only.

Debit vs. Credit Rate Examples

Putting this key metric data into action, using the above sample figures, a $50 signature transaction completed with a debit card would incur $.57 in interchange. The same $50 transaction completed with a credit card would be more expensive, costing $.83. Any debit purchase used with a PIN will cost the credit union more than a PINless transaction. While these are small charges individually, they quickly add up and impact a credit union’s bottom line.

What You Can Do to Plan Interchange Strategy

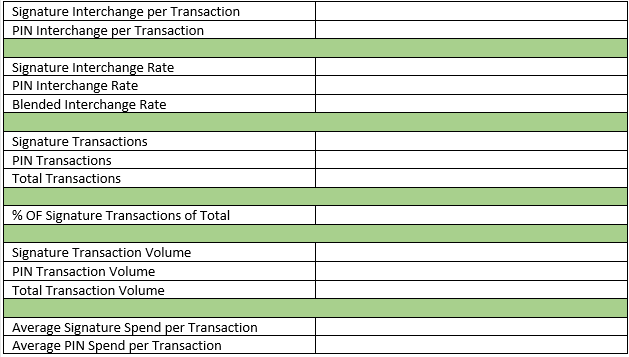

Setting up a scorecard for your credit union to identify various fees, track the different types of interchange income, and strategize a plan to manage your interchange income or loss is one place to start. For example, with debit interchange, a scorecard could look like this:

Debit Scorecard: PIN vs. Signature Transactions

Once you have your credit union’s data entered into your score card, you can start asking and answering questions to help set your strategy.

Synergent Can Help

Our team is here to assist and answer any questions you may have. Contact us to schedule your consultation today.