Contact Center Advanced enables credit unions to provide member-focused service experiences.

Contact Center Advanced enables credit unions to provide member-focused service experiences.

Being a credit union member means being more than just a number in a sea of customers. Loyalty is earned through positive, personal interactions that deliver what the member needs when they need it.

Think about your own experience as a customer. When you’ve had great interactions with a company, you’ve likely shared that experience with friends and family. The same is true when you have a negative encounter—not only do you tell others about it, but the company ultimately loses your business.

In fact, looking specifically at call experience, 47% of consumers have reported that they will stop doing business with a company if they have a negative contact center experience.

All things considered, your credit union’s call center is critical to member satisfaction. Some members may rarely or never enter your branch. Your call center is instead how they interact with your credit union. Ensuring members receive exemplary, positive, and memorable service is essential to fostering their credit union relationship and to your institution’s success.

Providing remarkable member service requires continued investment, improvement, and innovation. Contact Center Advanced is a cost-effective, flexible solution that helps build loyalty and exceed member expectations.

How It Works

In the competitive financial services market, providing high-touch, exceptional service is a key differentiator. Contact Center Advanced uses the latest tools and technology to deliver responsive, intuitive service to members.

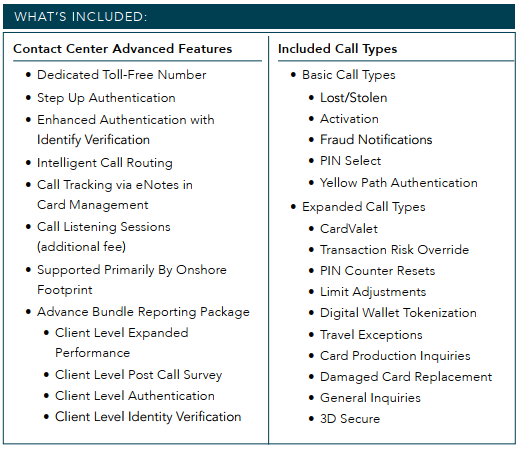

Contact Center Advanced fields calls such as fraud notifications, lost/stolen reporting, activation requests, and mobile wallet authentication, all of which are handled by seasoned member service professionals. The credit union can also use Contact Center Advanced as an option for after hours or 24/7 support, call overflow, or disaster recovery purposes.

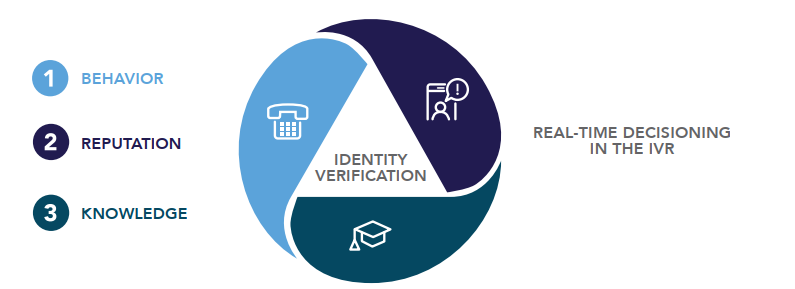

As a comprehensive solution, Contact Center Advanced uses a natural language interactive voice response system (IVR), along with advanced authentication to streamline workflow.

Full-Featured Solution

With credit unions of varying member size, asset size, and field of membership, the Contact Center Advanced bundle is flexible to meet varying needs. It includes event and complaint tracking, performance and authentication reporting, and post-call surveys. It also provides additional features, such as configurable IVR authentication, support for additional call types, follow-up reporting, and cardholder notifications.

Key Benefits

- Elevate your credit union brand with simple, exemplary service

- Meet cardholder needs and exceed expectations

- Minimize fraud losses through enhanced security and authentication

- Foster loyalty and increase retention through personal interactions

- Reduce overhead expenses

- Provide cost effective after-hours or 24/7/365 support

- Agilely adapt to ever-changing call volume

Learn More

Contact Center is currently available to all Synergent Fiserv EFT credit unions. For additional information on implementing Contact Center at your credit union, please contact your dedicated Account Relationship Manager, or email ARM@synergentcorp.com.