The paper check. While payments continue to rapidly evolve in the digital space, paper checks still have a prominent place in the lives of members. With the digital capabilities we have, do members still need to visit a branch in-person to deposit a check? They certainly can if they’d like to interact in-person, but they don’t have to thanks to Remote Deposit Capture.

The paper check. While payments continue to rapidly evolve in the digital space, paper checks still have a prominent place in the lives of members. With the digital capabilities we have, do members still need to visit a branch in-person to deposit a check? They certainly can if they’d like to interact in-person, but they don’t have to thanks to Remote Deposit Capture.

There are two types of this convenient solution: Mobile Remote Deposit Capture (mRDC) and Business Remote Deposit Capture (bRDC). While they both allow members to easily deposit checks remotely, there are some differences in the two offerings.

Mobile Remote Deposit Capture

For members on-the-go, mRDC allows them to quickly deposit checks remotely using their smartphones, without ever needing to enter the branch. This is a significant convenience to members in terms of time, but it also accelerates funds availability and increases mobile banking adoption. Credit unions can gain significant efficiencies by automating the check deposit process, increase mobile banking usage, and reduce manual review and approval thanks to the sophisticated risk management technology that is part of mRDC.

How It Works

For the member, the process is simple. Using their smartphone, members simply take a photo of the check they wish to deposit, then they use their mobile banking app to make the deposit in real time.

Behind the scenes, significant technology is at work to ensure check deposits are seamless. Starting with the check image usability, mRDC uses Mitek’s patented technology to translate the photo of the check into its scanner equivalent. If the technology is able to read the image, mRDC can continue processing. If not, the member is notified.

Once the image is cleared for use, the check undergoes rigorous real-time risk review. The patented Agile Risk Management platform leads the industry in cloud-based deposit risk mitigation. An algorithm evaluates each deposit using over 200 risk criteria, including duplicate detection. A library has been generated to help credit unions create personalized risk and deposit limit policies. For example, large checks may be handled on an exception basis. These steps have led to minimal fraud loss for users of mRDC. When the check is ready to post, the member sees their account balance updated in their mobile banking app in real time. If desired, a secondary review can be done by the credit union before a mobile deposit is sent for settlement.

“Members want to be able to quickly and securely deposit checks without visiting the branch,” shared Karen Martin, Product Owner-Payments for Synergent. “Because Mobile Remote Deposit Capture is so easy to use, members get comfortable with using this tool to make their deposits online in no time.”

Business Remote Deposit Capture

bRDC allows business members to deposit checks remotely using their choice of multiple devices. This can be a significant time saver for business managers trying to complete the many tasks they have during the workday. For example, a busy property manager can use a desktop computer with a check scanner to deposit 100 checks, or a small business owner can quickly use a smartphone to deposit 10 checks.

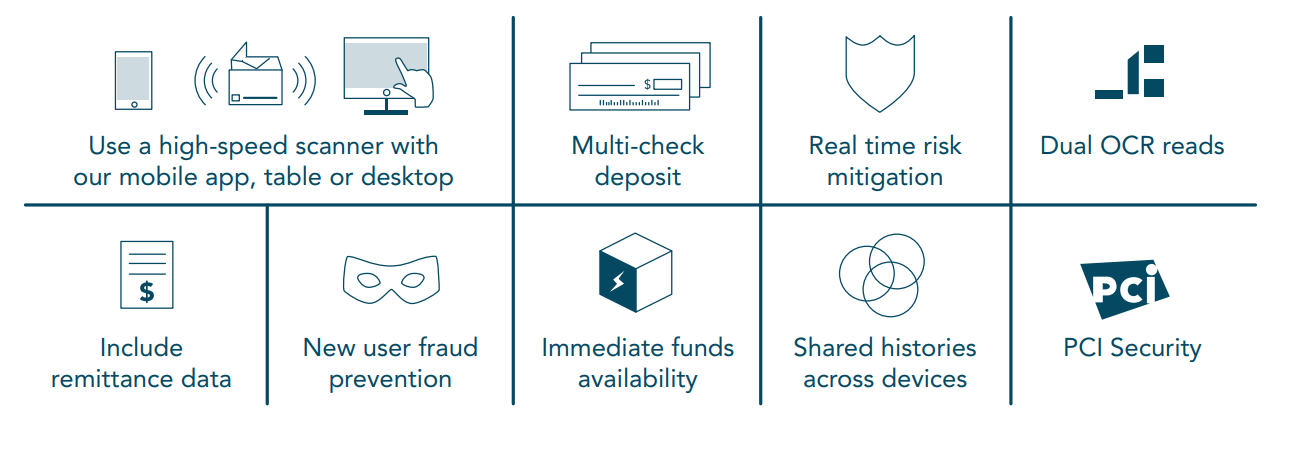

While the scenarios can vary, bRDC provides a seamless experience across all devices for businesses of all sizes. Users can make deposits and view transaction histories quickly from any device: mobile app, tablet, or desktop. With real-time processing, funds are available almost instantly.

How It Works

Please note: The following is an example of how bRDC works. Some functionality is dependent on your mobile banking provider. The Synergent team is available to discuss variances on a case-by-case basis.

bRDC provides business members with an omni-channel platform that allows access across all channels thanks to a universal, cloud-based application. Users can start with their desktop computer and scanner, then use their mobile device to pick up where they left off!

“Credit unions are continuing to compete with their business offerings against local and regional financial institutions,” explained Karen Martin, Product Owner-Payments for Synergent. “Members’ digital expectations have grown exponentially, so allowing their business members added digital convenience through bRDC helps them meet those needs.”

Business users also may opt to use bRDC with Ensenta Business Mobile with Multi-Check, a simple, fast way to deposit multiple checks in a single session using their smartphone.

Key Benefits

While the functionality differs between mRDC and bRDC, the key benefits are largely the same:

- Easily Deposit Checks Remotely: Provide members the flexibility to deposit checks anytime, anywhere.

- Increase Mobile Banking Adoption: Ease of use encourages members to use mobile banking solutions.

- Accelerate Funds Availability: Accelerate funds availability to low risk users and customize hold policies and segments that work for your credit union.

- Real-Time Processing and Posting: Increase back-office efficiencies with real-time posting of deposits that align with the core.

- Compliant Fraud and Risk Settings: Protect members and your credit union from fraudulent activity with agile fraud and risk mitigation tools. Leverage integrated products, such as EZAdmin™ or SmartAlert Real-Time Fraud Alerts.

- Instant Messaging: Members receive real-time messaging from their credit union, fostering affinity and providing a positive experience.

- Touchless: As a remote option, no physical contact needs to be made at a branch to deposit checks.

Learn More

To learn more about Remote Deposit Capture, please contact your Account Relationship Manager, or email ARM@synergentcorp.com.