2020 was the year like no other, but the payments world rebounded in many ways in 2021 with changes in consumer habits and shifts back to in-person transactions.

2020 was the year like no other, but the payments world rebounded in many ways in 2021 with changes in consumer habits and shifts back to in-person transactions.

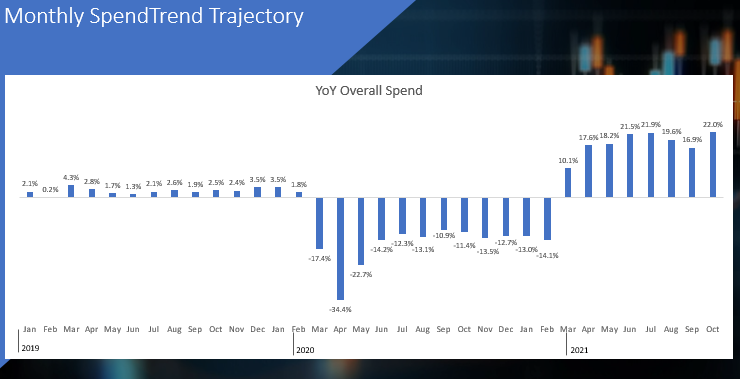

Consumers across the board were found to be spending more, especially in hotel, leisure, travel, restaurants, gas stations, and retail industries such as clothing and general merchandise. Overall, as of October 2021, year-over-year spending increased 22% and the retail sector saw 12.3% year-over-year growth. However, transactional growth was only 12.% overall and the average ticket size (which examines the dollar amount of sales per customer) was up 8.4% overall.

“Many factors are driving the spending acceleration,” explains Rebekah Higgins, Synergent Payments and Fraud Consultant. “The Consumer Price Index has risen to a decades-high level, supply chain interruptions continue globally, the pandemic persists, and an early launch for holiday sales fueled average ticket sizes to increase faster than transactions and drive spending in Q4 of 2021. The pace of transactional growth falling behind spending growth is somewhat concerning, as the average ticket increase was an indicator signaling the inflation we are now starting to see.”

The spend trajectory is most clearly illustrated when analyzing data from 2019 through the present. In 2019, monthly spend increases were modest and fairly uniform. In 2020, with the onset of the pandemic, they dipped significantly, to a low in April 202 of -34.4%, then began to rise in March 2021.

Source: Fiserv

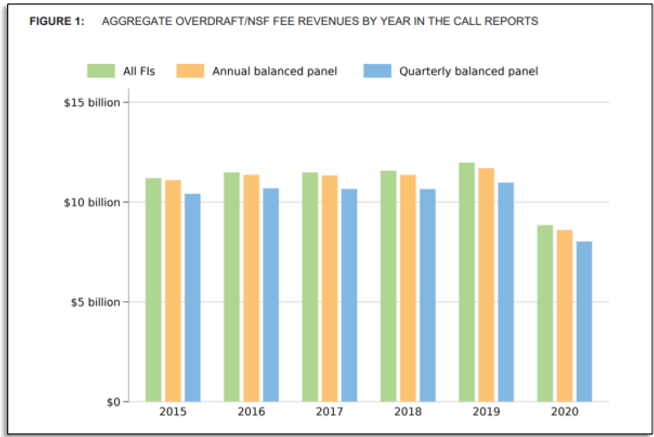

Rising Overdraft Fees

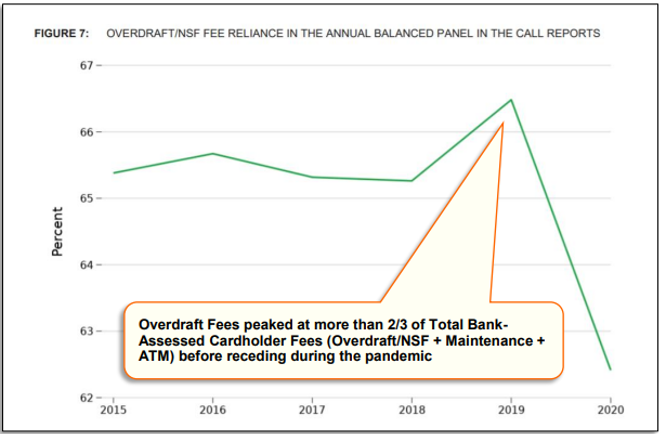

According to FDIC Call Report Data, overdraft fees have also steadily risen, both in absolute terms and as a percentage of total cardholder fees assessed:

Source: Fiserv

Source: Fiserv

“Credit unions have a unique opportunity to work with members to prevent NSF overdraft fees,” stressed Higgins. “In our People Helping People industry, promoting safety net programs in place at your credit union can both assist and retain your current members while attracting new ones who are seeking protection from excessive fees.”

Black Friday Trends

We are only a few weeks out from Black Friday, but we already have some compelling information from the robust consumer spending seen throughout the weekend.

PYMENTs.com conducted a survey of consumers to inquire about their Black Friday spending habits. They found that consumers overwhelmingly use debit and credit cards for in-store shopping over cash or “Buy Now Pay Later” (BNPL) solutions. And Mastercard data indicated overall sales growth on Black Friday weekend was up 14% year-over-year.

“We thought we’d see more in terms of cash usage or layaway solutions,” reflected Higgins. “However, shoppers who returned to brick-and-mortar locations preferred debit and credit card options, with debit usage narrowly ahead of credit. Debit being the preferred method by a small margin has now been true for the past two years. For credit unions, ensuring your card offerings are robust, providing loyalty rewards to members, and continuing programs such as ‘Christmas Club’ accounts are all ways to meet members’ needs while increasing your own interchange income.”

Payments & Fraud Consulting

Credit unions who partner with Synergent have the benefit of working directly with a Payments and Fraud Consultant who helps them maximize payment strategies, stay informed of current trends and how they impact product and service offerings, and be proactive in protecting members from fraud. Consultative services offered include:

- Review of the payments landscape at large

- Educate on disruptors and emerging financial technologies

- Product portfolio assessment

- Member engagement audit

- Custom ROI documentation for value-added services

- Review of current fraud trends

- Fraud mitigation strategy recommendations

Learn More

Credit unions who partner with Synergent are encouraged to schedule a consultation with Rebekah Higgins, our Payments and Fraud Consultant, to discuss ways to maximize your payments programs. Please contact your Account Relationship Manager, or email ARM@synergentcorp.com, to schedule your consultation.