The best is evolving to be even better. Earlier this year, Fiserv announced their acquisition of OnDot, a leading provider of card control management services. Their software drove the backend of Fiserv’s CardValet, as well as other card processor programs. As a result of this partnership, Fiserv will be offering a more comprehensive member-facing card management system called CardHub, that will encompass the functionality of CardValet, along with additional features.

What Does This Mean for CardValet?

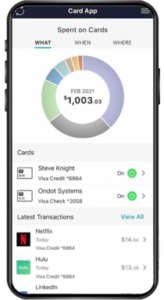

The launch of CardHub is a direct result of Fiserv’s OnDot acquisition. It provides self-service credit and debit card management, helping users further manage spending and keep their accounts secure.

CardValet will continue to operate as a premier card control management application. Enhancements to the app, as well as maintenance and fixes, will continue. Just last quarter, we launched new travel notification features that allow members to self-service and set travel exceptions anytime, anywhere. We will be sure to tell you if anything changes.

Though CardHub and CardValet do bear many similarities, they are not identical. The Synergent team is working with Fiserv to catalog any changes that will happen as a result of the launch of CardHub and how it could affect existing CardValet credit unions.

Roadmap Changes

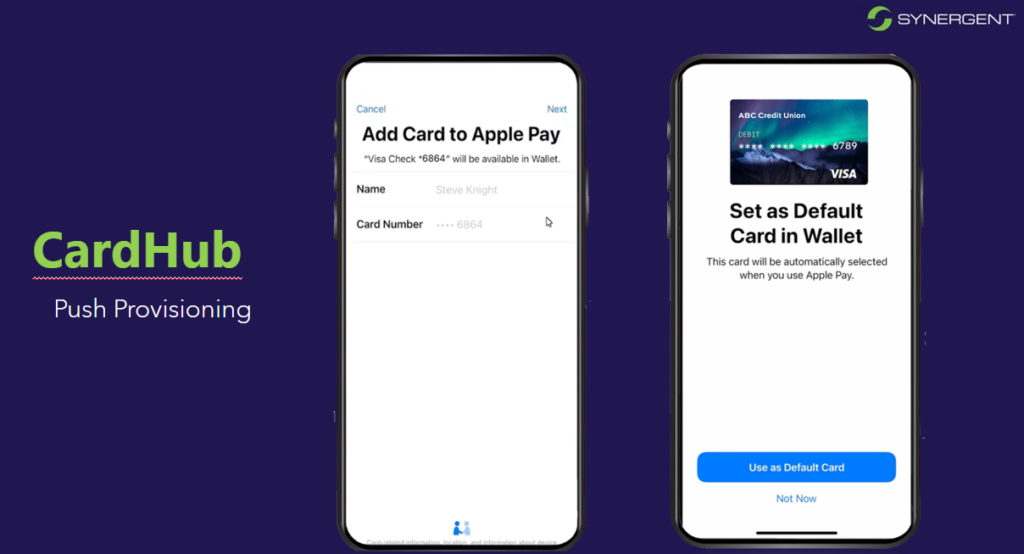

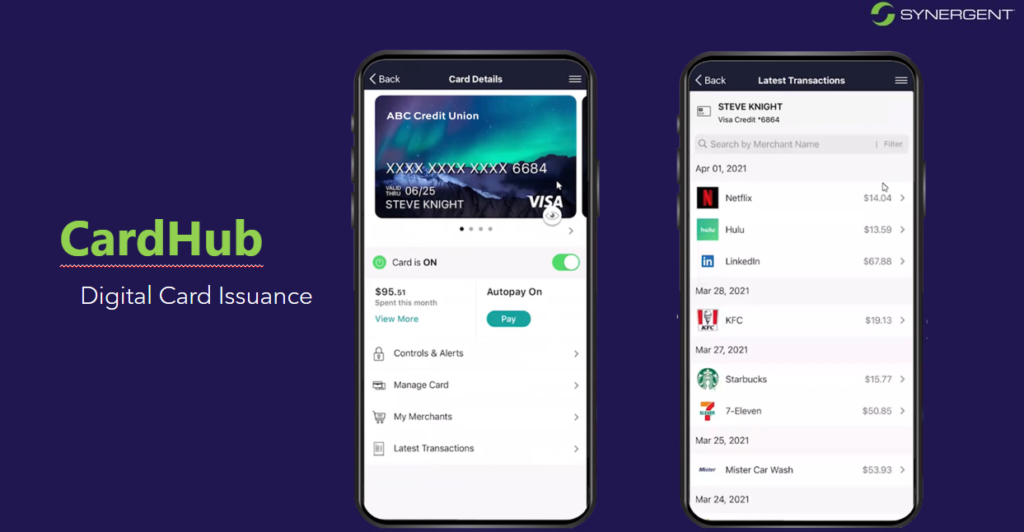

As a result of the acquisition, adjustments to our planned roadmap are anticipated in the areas of digital card issuance (Digital Card Advantage (DCA)) and push provisioning, to reflect the delivery of these features through CardHub. Availability is expected in early 2022 and we continue to work with Fiserv to finalize the product dates, rollouts, and core integration details. As with CardValet, these also will be dependent on integration capabilities with core and mobile app providers.

“We are very excited about CardHub” said Karen Martin, Product Owner – Payments for Synergent. “It’s so much more than just another upgrade or version of CardValet. It’s truly a new technology change and I think Fiserv will continue to bring some exciting capabilities. Rewards and pushing the card to the digital wallet are a couple of enhancements on the roadmap that we look forward to coming out of CardHub.”

Sneak Peek: Push Provisioning and Digital Card Issuance

Push Provisioning

The ability for your member to receive a prompt to add their card to their wallet is a significant advantage. For example, if a member is using Google Pay or Apple Pay, prompting a member to add your card can help your credit union stay top of digital wallet.

Digital Issuance

Digital issuance will provide significant benefits to members. Whether it is the ability to provision a card instantly upon opening an account or being able to give an instant replacement card digitally, the member has no wait time to have a payment method and access to their account.

Questions?

As mentioned prior, CardHub is expected to be available in early 2022. If you have questions leading up to the availability date, please contact your Account Relationship Manager, or email ARM@synergentcorp.com.