The payments landscape is always evolving, always advancing, and always changing. Staying informed about the products and services currently available and those that are on the horizon is essential, but also can be daunting. There’s constantly something new in the FinTech space and it can be difficult to know which products are a flash in the pan and which are the ones to focus on.

Faster payments indisputably is a key area that deserves your credit union’s attention. Credit unions offering faster payments are gaining a competitive edge and preserving top-of-wallet status, even if the wallet we are referring to is a digital one. But being informed is only part of what’s necessary to thrive as a financial institution during the Payments Revolution. Having a strategy to assess, implement, and rollout faster payments to meet member demand, then executing on the strategy, is essential.

“Credit unions and financial institutions are no longer competing solely with the institution around the block, they’re competing in a global payments market,” explained Karen Martin, Product Owner – Payments for Synergent. “Whether it is a third-party app holding payment information, a payments disruptor, or a competing FI with a broad field of customers, competition to remain at the top of the digital wallet is intense. The good news: the latest in faster payments and digital wallets is accessible and attainable for credit unions of all sizes and is a key way to gain market share and retain members.”

Faster Payments Defined

According to NACHA’s Faster Payments Playbook:

The term “faster payments” is broadly used in the payment industry to indicate simply that increased speed, convenience, and accessibility are essential features for the future of the payment and settlement system. In addition to the expedited movement and availability of funds, the more efficient and transparent provision of information about the transaction is a key component of the faster payments value proposition.

Members and consumers at large are moving funds through systems where they expect instant results. PayPal is a classic example of a funds transfer platform that jump-started the need for faster payments. Venmo, Zelle, and Facebook Messenger are a few places where funds are transferred instantly. While the platforms, apps, and wallets holding these options are in a phase of rapid growth, now is the time for credit unions to stay informed and understand the solutions available.

From Generation Z to Baby Boomers, consumers of all ages have become accustomed to fast and convenient digital experiences––often because of third-party mobile payment apps. As a result, members expect the same level of speed and convenience from their credit unions. By taking advantage of a payments hub solution, credit unions can benefit from streamlined, secure payment capabilities for sending and receiving near real-time payment transactions.

Payment Milestones

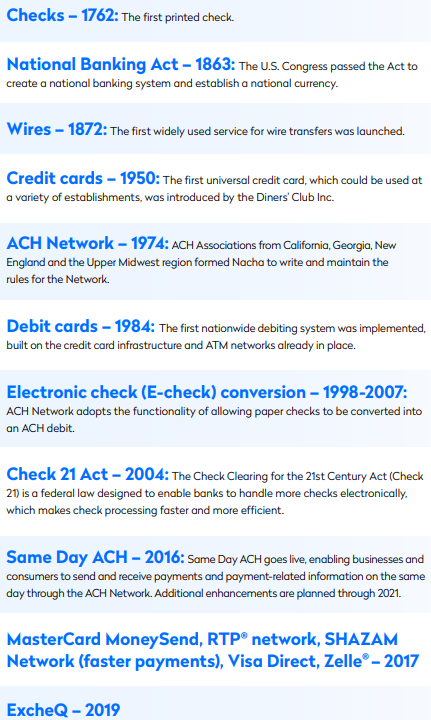

If it feels like the payments space has been moving incredibly fast over the past decade or so, it isn’t your imagination. NACHA recently shared a quick view of major payments milestones throughout history:

Source: NACHA

Setting Your Strategy

Start by identifying which areas in your credit union should participate in building your faster payments strategy. While not an all-inclusive list, a few common areas could include Compliance, Operations, Finance, and Marketing. Define roles and responsibilities from the start of the process and set a timeline.

Next, look at your field of membership and assess the competitive space you are in. Consider the needs of your existing members as well as prospective members and ask the following questions:

- What is the inventory of our current payment systems? How are we leveraging these systems today?

- How can faster payments fit into our current payments strategy?

Once these questions have been answered, identify the benefits and opportunities of incorporating a faster payments strategy. These may include:

- Staying relevant and competitive

- Membership retention

- Attracting new members

- Ability to add new, innovative payments products

- Gaining efficiencies

Finally, draft your strategy. Identify what types of solutions you want to be able to offer members, what infrastructure needs exist (if any), set a timeline, and map out metrics to evaluate the success of your strategy as it is implemented.

The Power of Partnership

Credit unions who partner with Synergent know they aren’t in this alone. The payments space moves fast. Part of the Synergent Advantage is being able to turn to experts who are not only versed in this evolution, but also work with credit unions of all member and asset sizes across the country.

“In working with us from a consulting perspective, I’m here to help,” stated Rebekah Higgins, Payments and Fraud Consultant for Synergent. “My role is to answer any questions credit unions have on implementing a faster payments strategy and about payments in general. This is moving fast, but this is not a flash in the pan and credit unions must be ready and positioned to move forward with this technology as it advances. To wait is to be left behind. Remaining relevant and providing members with the financial tools they need correlates to both retention and growth.”

What You Can Do

Assembling the operational infrastructure of a faster payments method from scratch can be difficult. By utilizing an existing and tested payments hub resource, your credit unions’ payments strategy can be aligned with member needs and expectations. A payments hub solution can provide many benefits, allowing credit unions to compete with emerging disruptors in the industry.

Synergent is here to help. Contact us to get started on your faster payments strategy.