The core processor is essentially the brain of any credit union. It houses all of the sensitive member data that drives a credit union’s operations. It is the hub of information from which all automated processes and teller-driven transactions are drawn.

Synergent is pleased to provide Symitar® Episys® core processing as an outsourced solution to credit unions. It is a flexible workhorse of a core that easily integrates with the latest, most in-demand financial products and services. But, being the sophisticated core processor that it is, there’s a lot of knowledge to maintain in order for credit unions to maximize their core processing investment. Staff turnover, employees wearing many hats, the need for rich (but time-consuming) member interactions, and the everchanging world of technology all make it difficult for staff to be sure they are strategically maximizing their Episys core investment.

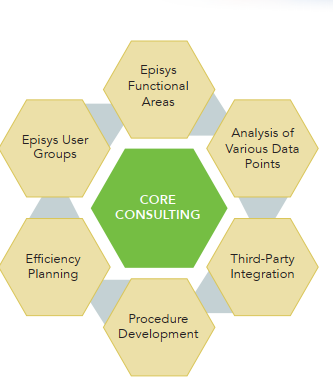

Core consulting is a new solution exclusively for Synergent partner credit unions. We have Episys subject-matter experts on staff who are prepared to help credit unions grow shares, increase loans, and gain efficiencies through strategic consults. We bring together all of the pieces in a holistic, 360-view.

“Synergent’s provision of hosted Symitar® Episys® core processing isn’t limited only to the product itself,” shared Jen Berry, Vice President of Core Conversions and Consulting. “Our team of experts is here to holistically help credit unions as consultants, a single source for core expertise and recommendations. Our goal is to help credit unions improve performance in operations, management, revenue, and growth strategy.”

Types of Consultations

Different credit unions have different needs. As such, there are four different types of consultations offered to credit unions who partner with Synergent: Efficiency Consult, Targeted Consult, Deep Dive Consult, and New Product Consult.

Efficiency Consult

This complimentary consultation focuses on ensuring a credit union is using all of their existing core products and services as efficiently as possible. This is not a sales opportunity: the focus is solely on a credit union’s existing product set. No new implementations will occur as an outcome of an Efficiency Consult. The purpose is to help a credit union make the most of their Episys core investment and the add-on modules they’ve already purchased.

Targeted Consult

The Targeted Consult digs into a specific focus area, such as collections, lending, application processing, or technology adoption. This may include extra guidance and project management for single product deployments. The process will culminate with an actionable, systematic change that takes place on a “Go Live” date. Typically, this consult takes 8 to 16 hours to complete. If more time than that is required, a Deep Dive Consult may be needed.

Deep Dive Consult

The Deep Dive Consult is similar to the Targeted Consult in that it is a system review of a specific focus area, such as collections, lending, application processing, or technology adoption, but it is a more intensive process, requiring over 16 hours to complete. It also may include additional guidance and project management for single product deployments, but it is intended to provide actionable, systematic change with suggestions for the credit union to consider and configuration to extract the greatest value possible for the specified area.

New Product Consult

The New Product Consult is led by the credit union’s dedicated Account Relationship Manager and involves assessing and recommending new products for credit unions to adopt to increase year-over-year growth and improve internal and external service. This will help credit unions select products that will provide members with innovative, in-demand products and allow them to learn about, understand, and make strategic investments based on market trends.

Great Experience

Oswego County FCU, headquartered in Oswego, NY, recently completed an Efficiency Consult. They were very pleased with the experience.

“The Efficiency Consult was just what we needed to be sure we were performing and on track with using the core,” reported Oswego County FCU. “It was enlightening not only to gain some more knowledge, but also to get some dedicated attention from some of the pros, to pick their brains about how things run and how we are doing things. Great job, Synergent, on meeting our needs and providing us some great guidance.”

Learn More

Core consulting is a service exclusively available to Synergent partner credit unions. To schedule your core consulting session, please contact your dedicated Account Relationship Manager.