Members are on-the-go. Whether you’re informing new credit union members for the first time about the products and services your credit union provides or reminding longtime, established members of tools that they may have forgotten they have access to, consider launching your next onboarding/reboarding campaign with a focus on eServices.

What is Onboarding and Reboarding?

Onboarding is a marketing campaign that uses a combination of phone calls, emails, direct mail, and social media to welcome new members to your credit union while informing them of the products and services most relevant to them. With the first 90 days of membership being a critical time to establish solid relationships, onboarding seeks to establish strong connections while educating your newest members about your credit union’s offerings.

Reboarding is similar to onboarding, but it instead targets your longtime, established members to ensure they are aware of the products and services available to them. Again, by using a combination of marketing channels, your credit union communicates with its established members through a targeted campaign that feels personal, timely, and relevant.

Both onboarding and reboarding campaigns are proven to:

- Improve member retention, decrease churn, and create valuable relationships

- Increase cross-selling success, creating greater product penetration

- Help members feel more closely connected to your credit union

Roundup: eServices to Remind Members About

When using the term “eServices,” we’re referring to some of the online, digital tools that members can access any time, anywhere, without needing to visit the branch.

“Members are busier today than ever,” said Doug MacDonald, Vice President of Marketing Services. “eServices became even more popular during the COVID-19 pandemic because they are touchless, remote options. Now, with restrictions lifted in most areas, people are back on-the-go, but want to retain the flexibility that remote services provide. Ensuring that new and established members alike are aware of your credit union’s offerings helps them gain convenient access while driving product adoption at your credit union.”

-

Digital Banking

Digital banking has been adopted by many members, but not all members. The convenience of accessing their accounts through your traditional online banking portal from a computer or through the corresponding app on their phone or tablet is significant. Cost and time savings, along with quick access to credit union resources and the ability to receive important communications are a few benefits to highlight.

-

Digital Wallets

Digital wallets virtually store cardholder payment information and allow users to securely complete transactions using their smartphones, smartwatches, or other devices. If shopping online, digital wallets can eliminate the need for the user to input card information for each transaction.

Major, well-known digital wallets include Apple Pay, Amazon Pay, Samsung Pay, and Google Pay, but additional options continue to enter the market. Being top-of-wallet means being first-in-app when describing digital wallets. Reminding members of benefits like touchless capability, being able to set a default card, the convenience of not needing to carry a physical card, speed, and security are a few messaging areas that can be developed.

-

eStatements

Increase eStatement adoption by highlighting key benefits. They are more reliable, received faster, and are environmentally friendly. On the credit union side, they are cheaper to produce and share, a savings that can be passed on to members. Those members who already have signed on for digital banking, but have not signed up for eStatements, would be a prime group to target in this segment of your onboarding/reboarding campaign.

-

Bill Pay

For a multitude of reasons, in a variety of industries, there are numerous disruptions and delays being experienced right now. Bill Pay provides an immediate option for members to make payments immediately, eliminating the need to mail payments that could be late to post and mitigating late fees for payments such as credit cards, mortgage, and auto loans.

-

Remote Deposit Capture

Whether targeting business or consumer members, there’s a Remote Deposit Capture (RDC) solution for each! The ability to take a photo of a check using a smartphone to quickly and easily deposit checks automates what was once an in-person, paper process. Increasing mobile banking adoption, accelerating the availability of funds, and mitigating risk are a few benefits to RDC, but the prime message to communicate to members is convenience.

Onboarding Success: Sebasticook Valley FCU Onboarding Campaign Case Study

Your brand should tell a story about who your credit union is, but it also needs to resonate emotionally with your members. Sebasticook Valley FCU and Synergent partnered to develop a strategy, design, and content to bring their onboarding campaign to life.

Sebasticook Valley FCU recognized that many new members were not aware of all of the products and services available to them. In launching an automated onboarding campaign, the goal was to welcome new members while increasing product penetration and member retention. During their first 30 days of membership, new members received a personalized postcard with an outdoorsy theme featuring words like “discover,” “explore,” and “navigate” to suggest actions the member could take in adopting additional products and services.

To further connect with their members, imagery was chosen that reflected the region in which Sebasticook Valley FCU is located: an outdoor haven for nature enthusiasts that contains lakes, rivers, and ever-changing foliage. From this idea, “Experience Maine” was born. The idea of experiencing Maine with a financial partner that knows and understands its members leads to trust, member retention, and continued growth.

Since the start of the onboarding program, Sebasticook Valley FCU has been adopting the “Experience Maine” theme, look, and feel with its branded collateral. From drive-up envelopes and member agreements to auto and credit card direct mail campaigns, the collateral showcases a relatable, professional, colorful, and fresh look while reinforcing the Sebasticook Valley FCU brand. The theme, brought to life by Synergent’s award-winning creative team, was judged among hundreds of credit union marketing entries and won a Gold Marketing Association of Credit Unions (MAC) Award for Image Enhancement and a CUNA Marketing & Business Development Council Diamond Award for Brand Awareness.

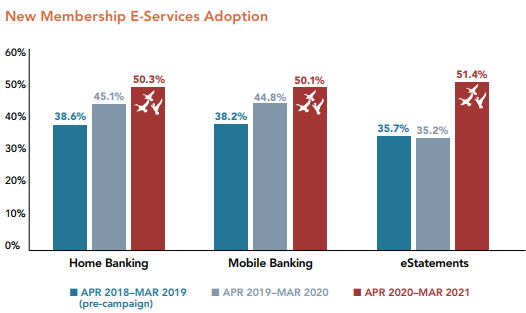

Replicating the campaign has allowed Sebasticook Valley FCU to realize year-over-year campaign growth, particularly in the area of eServices adoption:

Click here to download the full case study.

Learn More

To learn more about getting started on your next eServices onboarding and reboarding campaign, please contact us today.