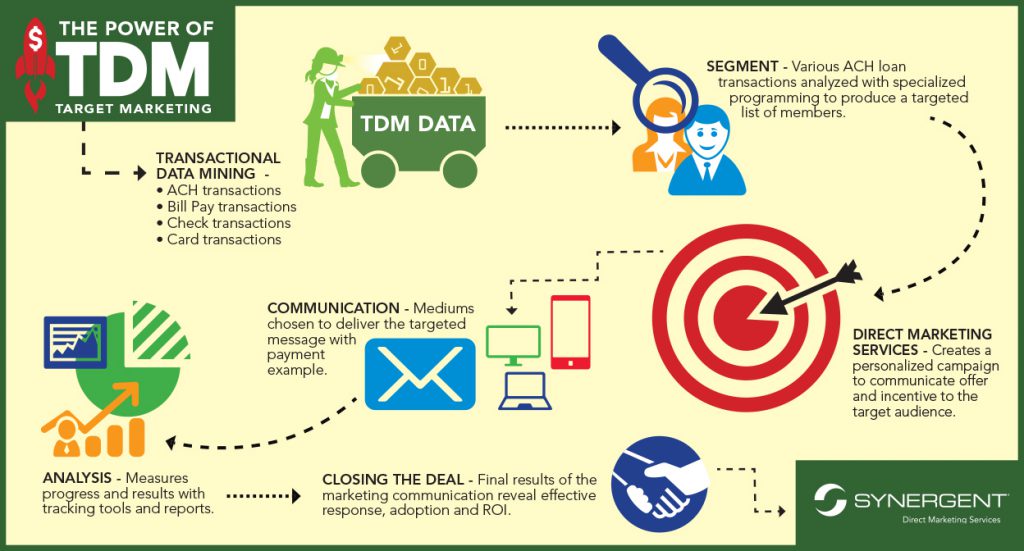

Leveraging your credit union’s data to drive results should be a top priority. With data available from sources such as the core, ACH, and custom reports, you have information that many other companies are paying for available at your fingertips! Leveraging data is proven to increase ROI and targets the right members, with the right offer, at the right time.

TDM Success – Northern Credit Union

Northern Credit Union, based in Watertown, NY, is a milestone example of how Transactional Data Mining (TDM) and targeted marketing are effective, both for members and for the credit union. Partnering with Synergent, they launched a two phase, cost-effective ACH auto loan recapture campaign that brought in about $2.2 million in additional loans that tied directly back to the target list. Combined, over $9 million in combined new auto loans overall were brought in during the 3-month campaign periods.

Seeking to increase their auto lending portfolio, they offered members incentives such as cash back, rates as low as 2.95%, the option to apply online, and flexible terms up to 72 months. Synergent assisted Northern CU by providing custom ACH data mining and targeted data extract programming to focus their marketing efforts on their target audience. Synergent Direct Marketing Services also assisted with the postcard production and mailing, utilizing graphics designed in-house at Northern FCU.

“It was very rewarding to help Northern CU identify and act upon so many unique marketing opportunities in their member transactional data,” stated Jen Braziel, Synergent Data Mining Specialist.

In the first two years alone, an estimated $215,446 of interest income can be tied directly to the postcard and email list used in this ACH data mining campaign. And as an added bonus, Synergent’s subsequent reporting and analysis shows that, in addition to the auto loans, an additional $1.3 million in additional non-auto lending during the second phase of the campaign also could be tied directly to the postcard and email list.

This successful campaign was also featured in a CreditUnions.com article.

The Journey: How We Get There

Different levels of targeting complexity are considered when determining your audience. Below are a few examples:

- Simple Target Group –A mailing list for all members ages 18-55 with no current auto loan with the credit union, and the usual marketing exclusions (no bankruptcies, charge-offs, privacy warnings etc.

- Moderate Target Group –A mailing list for all members ages 18-55 with no current auto loan with the credit union, a checking account with a balance of at least $100 and a credit card, and the usual marketing exclusions (no bankruptcies, charge-offs, privacy warnings etc.)

- Complex Target Group –A mailing list for all members ages 18-55 with the usual marketing exclusions (no bankruptcies, charge-offs, privacy warnings etc.) and fits at least one of these target criteria:

- Member has an auto loan maturing in the next 12 months –no other auto loans

- Member recently paid off an auto loan in the past 12 months –no other auto loans

- Member has made ACH payments to another auto lender in the past 3 months –no other auto loans

This data can be accessed using custom PowerOn programming, or through EasyWriter or Access. These methods each have their pros and cons depending on the complexity of the data being pulled. Actionable insights are uncovered, such as email penetration, members making payments to other lenders, dormant accounts, and average products per member.